Network Visualizations

Beta Version: Relationships between Investment Banks & Ratings Agencies (select securitization markets); it seems as though Investment Banks work engage different Ratings Agencies when they co-Manage an issuance than when they do so on their own.

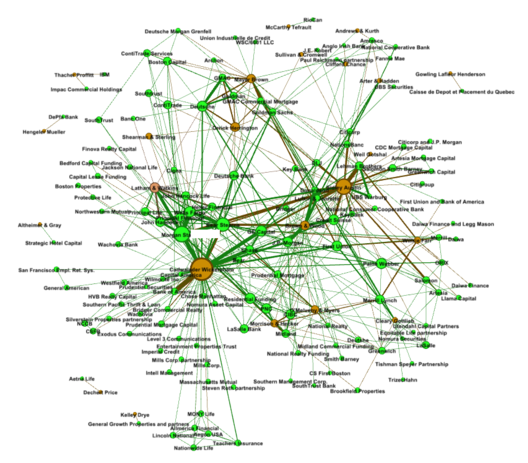

Bi-partite network analysis of CMBS issuers and their law firms (2013/2014 deals)

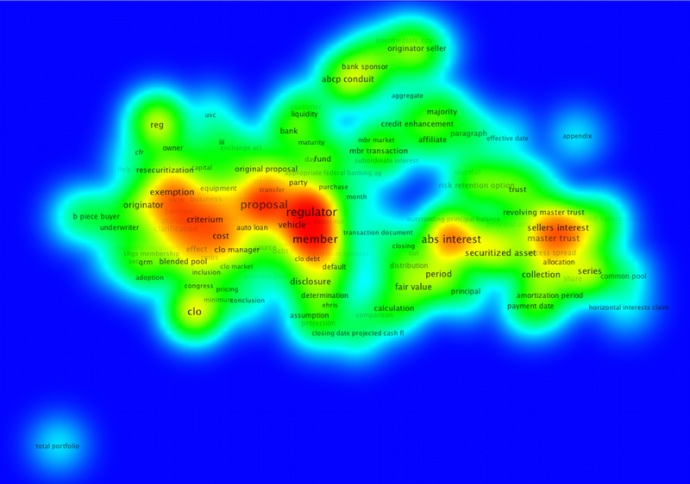

Heat Map of a Structured Finance Industry Group position paper (part of a developing Computational Content Analysis project)

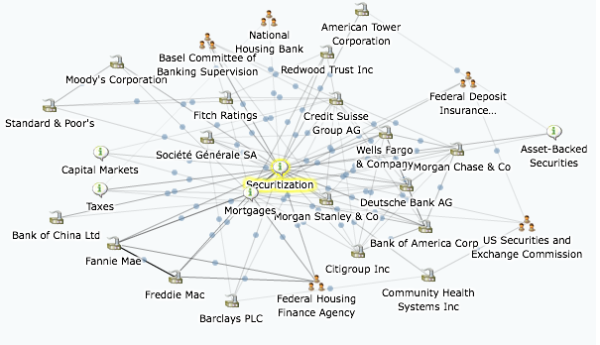

Selected Securitization Organizations and Concepts

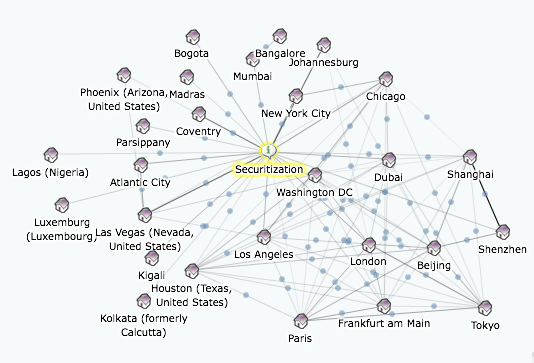

Geography of Securitization (March 2013)

COMING SOON:

I have compiled some datasets that span the history of various securitization financial markets, and am in the midst of analyzing this "big data" with a goal of rendering visible various relationships over time and related potential impacts. I am currently producing the following:

- Time Series Visualizations

- Dynamic Network Video (depicting organizations throughout the history of various securitization financial markets; using Gephi)

- Deal-Based Visualizations (using the iGraph package in Python and R)